The Trusted Choice in Estate PlanningHelping Families With Their Estate Planning Needs Since 2003

At The Law Offices of Patricia Bloom-McDonald, we are highly regarded as skilled attorneys and compassionate people who care about our clients. Once you become our client, you can expect to receive professional and personalized legal services. We have extensive experience handling all aspects of estate planning, including:

- Wills and trusts

- Powers of attorney

- Advanced directives for healthcare (healthcare proxy)

- Living wills

- Long-term care planning

- Medicaid/MassHealth planning

- Special needs planning

- Real estate transactions

- Business succession planning

- Probate and estate administration

- Veterans benefits

Knowing that no two estates are alike, we will work closely with you to tailor a plan to your unique needs and objectives. During our initial consultation, we will take the time to get to know you, learn about your circumstances, and explore all your options.

A well-conceived estate plan is not just about planning for your passing but also about mapping out your financial future. We can advise you on asset protection, retirement, and long-term care planning.

When you work with our firm, you gain a highly skilled team dedicated to your success. Trust us to help you plan your estate with confidence and give you peace of mind.

Westport Elder Law AttorneyAging in Place with Dignity and Grace

People in Massachusetts and around the country are living longer today, but the challenges of aging are real. How will you cover the costs of medical care? What if you need rehabilitative or skilled nursing care? How can you protect your assets if you become temporarily or permanently incapacitated?

These are daunting possibilities, but the responsible thing to do is plan ahead. That’s where our firm can assist you. Our comprehensive legal services include:

- Asset protection planning

- Healthcare planning with advanced medical directives

- Long-term care planning

- Establishing special needs trusts, conservatorships, and guardianships

- Selecting the right skilled nursing or assisted living facility

- Medicaid (Mass-Health) planning

We are keenly aware that preserving your autonomy, aging in place, securing your financial resources, and protecting your well-being is essential. You can depend on our elder law attorney to provide the compassionate, knowledgeable, and personalized service you need and deserve.

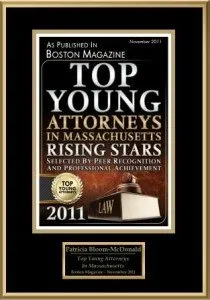

Awards & Accolades

What Makes Us Different?Values | Experience | Results

Whether you are just starting your estate planning journey, need help updating an existing plan, or administering a loved one’s estate, our firm will provide compassionate, efficient representation and dependable service.

Backed by over 30 years of experience, you can trust us to help you plan today to prepare for tomorrow. When we meet, you will find a welcoming environment where you can make informed decisions about your future. We will explain your options in clear, easy-to-understand language and help you design a plan that accomplishes your unique goals.

Our firm offers cost-effective services with your budget in mind, convenient payment arrangements, and complimentary consultations. Let us help you find the best solution to satisfy your legal needs.

Memberships & Friends

- American Bar Association

- Massachusetts Bar Association

- Massachusetts Collaborative Law Council

- Massachusetts Elder Affairs

- National Academy of Elder Law Attorneys

- Real Estate Bar Association for Massachusetts

- University of Massachusetts School of Law, Dartmouth

- Mass Association of Realtors

- Norfolk Bar Association

- Mass NAELA

- Resources to Remember

- Bristol County Bar Association

Talk to Our Experienced Westport Estate Planning Lawyer Today

At The Law Offices of Patricia Bloom-McDonald, our guiding principle is to put our clients’ best interests first. Contact us today to start your estate planning journey on the right foot.

"*" indicates required fields